This wiki is no longer being updated as of December 10, 2025.

|

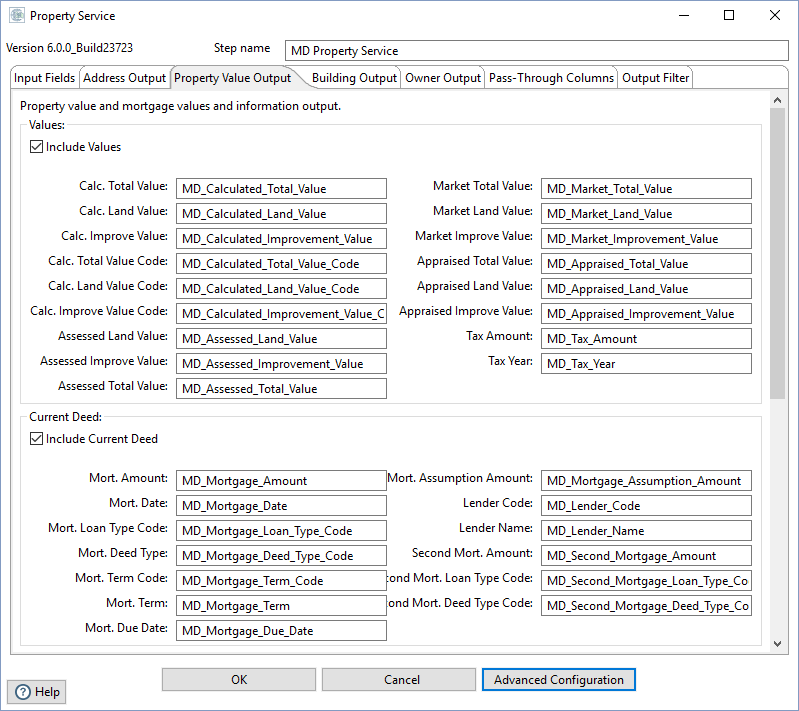

Pentaho:Property Value Output

Jump to navigation

Jump to search

← Data Quality Components for Pentaho

| Property Navigation | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Overview | |||||||||

| Tutorial | |||||||||

| Advanced Configuration | |||||||||

| |||||||||

| Result Codes |

This tab lets you check the box next to the groups or columns you want to output for the property value and mortgage values information. The following are definitions of the available groups and columns. For a list of codes returned by these columns, refer to Property Codes.

Values

These fields contain data on the current value of the property.

- Calc. Total Value

- The “TOTAL” (i.e., Land + Improvement) Value closest to current market value used for assessment by county or local taxing authorities.

- Calc. Land Value

- The “LAND” Value closest to current market value used for assessment by county or local taxing authorities.

- Calc. Improve Value

- The “IMPROVEMENT” Value closest to current market value used for assessment by county or local taxing authorities.

- Calc. Total Value Code

- The code appearing in this indicator field reflects the type of values (e.g., Market, Appraised) used to seed the TOTAL VALUE CALCULATED field.

- For a list of possible codes returned for this element, see Property Codes - Total Value Calculated Indicator.

- Calc. Land Value Code

- The code appearing in this indicator field reflects the type of values (e.g., Market, Appraised) used to seed the LAND VALUE CALCULATED field.

- For a list of possible codes returned for this element, see Property Codes - Total Value Calculated Indicator.

- Calc. Improvement Value Code

- The code appearing in this indicator field reflects the type of values (e.g., Market, Appraised) used to seed the IMPROVEMENT VALUE CALCULATED field.

- For a list of possible codes returned for this element, see Property Codes - Total Value Calculated Indicator.

- Assessed Land Value

- The Assessed Land Values as provided by the county or local taxing/assessment authority.

- Assessed Improvement Value

- The Assessed Improvement Values as provided by the county or local taxing/assessment authority.

- Assessed Total Value

- The Total Assessed Value of the Parcel's Land & Improvement values as provided by the county or local taxing/assessment authority.

- Market Total Value

- The Total Market Value of the Parcel's Land & Improvement values as provided by the county or local taxing/assessment authority.

- Market Land Value

- The Market Land Values as provided by the county or local taxing/assessment authority.

- Market Improvement Value

- The Market Improvement Values as provided by the county or local taxing/assessment authority.

- Appraised Total Value

- The Total Appraised Value of the Parcel's Land & Improvement values as provided by the county or local taxing/assessment authority.

- Appraised Land Value

- The Appraised Land Values as provided by the county or local taxing/assessment authority.

- Appraised Improvement Value

- The Appraised Improvement Values as provided by the county or local taxing/assessment authority.

- Tax Amount

- The Total Tax amount provided by the county or local taxing/assessment authority.

- Tax Year

- The tax or assessment year for which the taxes were billed.

CurrentDeed

These fields contain information about the current mortgage holder on the property.

- Mort. Amount

- The amount of the first mortgage as depicted on the recorded document.

- Mort. Date

- The date the Mortgage was initiated.

- Mort. Loan Type Code

- Type of loan secured (e.g., Conventional, FHA, VA).

- For a list of possible codes returned for this element, see Property Codes - Mortgage Loan Type Code.

- Mort. Deed Type

- Type of deed used for recording (e.g., Agreement of Sale, Assumption, Correction Deed).

- For a list of possible codes returned for this element, see Property Codes - Mortgage Deed Type Code.

- Mort. Term Code

- This code is used to identify whether the number stored in the MORTGAGE TERM field is in Days, Months or Years.

- For a list of possible codes returned for this element, see Property Codes - Mortgage Term Code.

- Mort. Term

- The length of time before the mortgage matures (e.g., 15yrs, 30 yrs, 45dys).

- Mort. Due Date

- The date the mortgage amount becomes due.

- Mort. Assumption Amount

- The assumption amount related to an existing mortgage.

- Lender Code

- This is a FARES internal code used to identify the Lending Company that was associated with the sales transaction.

- Lender Name

- This is the name of the lender on the original recorded document.

- Second Mort. Amount

- This is the amount associated with the 2nd mortgage.

- Second Mort. Loan Type Code

- Type of loan secured as part of the 2nd mortgage (e.g., Conventional, FHA, VA).

- Second Mort. Deed Type Code

- Type of deed used for recording the 2nd mortgage (e.g., Agreement of Sale, Assumption, Correction Deed).

CurrentSale

These fields contain information from the most recent sale of the property.

- Transaction ID

- This is a FARES internal number used to identify a specific transaction. This number may aid customers in the creation of unique keys.

- Document Year

- The year a sales transaction document was recorded (e.g., 1984).

- Deed Category Code

- The type of deed used to record the sales transaction (e.g., Grant, Quit, Foreclosure).

- Recording Date

- The date the sales transaction was recorded at the county (e.g., 19621028).

- Sale Date

- The date the sales transaction was legally completed (i.e., contact signed) (e.g., 19621025).

- Sale Price

- Price of the sale as depicted on the recorded sales transaction.

- Sale Code

- This field indicates whether the financial consideration is F = Full or P = Partial.

- For a list of possible codes returned for this element, see Property Codes - Sale Code.

- Seller Name

- The seller's name as it appears on the recorded sales transaction.

- Multi APN Code

- The data contained in this field depicts multiple or split parcel sales.

- Multi APN Count

- This reflects the number of parcels associated with the sale (e.g., 14 parcels recorded on the same document number).

- Residental Model

- A code to indicate whether the property is residential based on individual ZIP codes and values. “Y” = yes, “N” or blank = no.

PriorSale

These fields contain information about a sale of the property prior to the most recent one.

- Transaction ID

- This is a FARES internal number used to identify a specific transaction. This number may aid customers in the creation of unique keys.

- Document Year

- The year a sales transaction document was recorded (e.g., 1984).

- Deed Category Code

- The type of deed used to record the prior sales transaction (e.g., Grant, Quit, Foreclosure).

- For a list of possible codes returned for this element, see Property Codes - Deed Category Code.

- Recording Date

- The date the sales transaction was recorded at the county (e.g., 19621028).

- Sale Date

- The date the sales transaction was legally completed (i.e., contact signed) (e.g., 19621025).

- Sale Price

- Price of the sale as depicted on the recorded sales transaction.

- Sale Code

- This field indicates whether the financial consideration is F = Full or P = Partial.

- Transaction Code

- This identifies situations associated with the sale (e.g., Resale, Construction Loan, Seller Carryback).

- Multi APN Code

- The data contained in this field depicts multiple or split parcel sales.

- For a list of possible codes returned for this element, see Property Codes - Multi APN Code.

- Multi APN Count

- This reflects the number of parcels associated with the sale (e.g., 14 parcels recorded on the same document number).

- Mort. Amount

- This is the amount associated with the mortgage of the prior sale.

- Deed Type Code

- Type of deed used for recording (e.g., Agreement of Sale, Assumption, Correction Deed).